Introduction

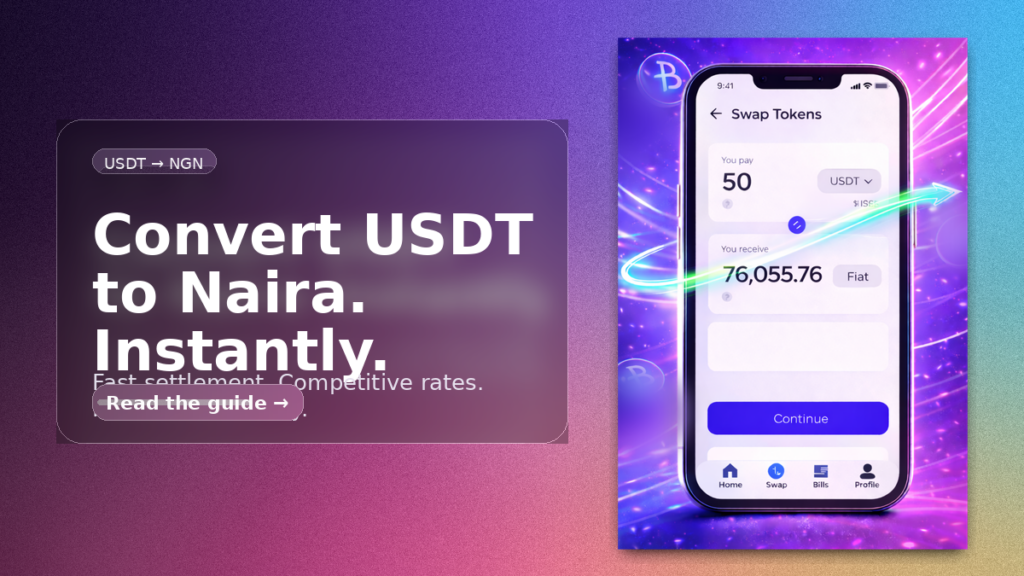

Converting USDT to Naira has become a common practice in Nigeria’s crypto-savvy economy. Whether you’re a freelancer paid in USDT, a trader taking profits, or receiving money from abroad, being able to instantly convert USDT to naira is crucial. Gone are the days of waiting days for international transfers – today you can swap USDT to NGN and get cash in your bank within minutes. This 2026 guide will walk you through the fastest ways to cash out USDT in Nigeria, with a focus on safety, best rates, and minimal fees.

Why is instant USDT-to-Naira conversion so valuable this year? For one, the Nigerian Naira’s value has seen sharp declines – losing about 40% in 2024 alone. This means many Nigerians prefer holding savings in USD-pegged stablecoins like USDT to hedge against inflation and devaluation. In fact, Nigeria is among the world’s leaders in stablecoin usage, accounting for nearly $22 billion in stablecoin transactions over a recent year. USDT provides stability, but eventually people need Naira for daily expenses. That’s where instant off-ramps come in. By using the methods in this guide, you can preserve value in USDT until the moment you need to spend, then convert to NGN at the best rate and spend or withdraw locally without delay.

Why Instant Conversion Matters

Speed and convenience define the modern crypto off-ramp. An instant USDT to NGN conversion means:

- Cash Flow for Daily Needs: You might receive USDT from overseas (remittances, earnings) and need to pay rent or go shopping today. Instant conversion gets Naira in your bank or mobile wallet when you need it. For example, one user got paid in USDC on a Friday and was “shopping with naira within 5 minutes” using an instant off-ramp.

- Opportunity Timing: Crypto markets can be volatile. If you decide to cash out profits at a specific price, a fast conversion locks in your NGN amount. Delays can mean exchange rate slippage or price movement.

- Emergencies: If you suddenly need fiat cash (medical need or urgent purchase), being able to quickly liquidate some USDT provides a safety net. You don’t want to be stuck waiting 24-48 hours for a withdrawal on a traditional exchange while an emergency looms.

- Arbitrage and Savings: Instant conversion platforms often use competitive parallel market rates for USD/NGN, which are generally higher (more naira per dollar) than official bank rates. By converting via crypto P2P/off-ramps, Nigerians often get a better exchange rate for their dollars. Speedy transactions ensure you capture that rate without it shifting.

- Peace of Mind: Knowing that you can turn your digital assets into local currency on-demand gives confidence to hold and use crypto. It bridges the gap between the crypto economy and everyday life needs.

Nigeria’s regulators have warmed up to crypto – the ban on crypto banking was lifted in 2023 and new rules in 2025 formalized the industry. As a result, more instant ways to convert USDT to naira have emerged, and banks are more open to interfacing with crypto platforms. Let’s explore the best ways to convert your USDT to Naira instantly.

Related: Buy MTN Data With USDT Instantly (2026)

Top Methods to Convert USDT to NGN

When it comes to turning USDT into spendable Naira, you have a few avenues. We’ll cover the most popular ones:

1. Crypto Off-Ramp Apps (Instant Withdrawal Services)

These are dedicated services (usually mobile apps or web platforms) that specialize in converting crypto to fiat and depositing it into your bank account or mobile money. They offer speed and simplicity:

- Ravasend: Ravasend is a Nigerian fintech platform known for digital payments and crypto off-ramp. Ravasend is designed to convert stablecoins like USDT/USDC to Naira instantly, straight to your bank at highest possible rate. You initiate a withdrawal, and Ravasend (through its licensed partners) sells your USDT and transfers Naira to your provided bank account instantly. The service charges a transparent fee but uses real-time market rates with no hidden FX markup. This means if 1 USDT is trading at ₦1480, you get roughly ₦1450 per USDT minus the small fee. The ease of use is excellent: you just enter how much USDT to convert, your bank details, and confirm. Many users in Nigeria find this approach hassle-free compared to dealing with peer-to-peer trades.

- Yellow Card: A popular Africa-focused crypto exchange. Yellow Card supports converting USDT (and other cryptos) to Naira. They have a feature called Yellow Pay which can facilitate sending and withdrawing funds. You deposit USDT into your Yellow Card wallet (they support multiple stablecoin networks), then sell it for NGN within the app. You can then withdraw to your Nigerian bank account. Withdrawals often happen within the same day, and many users report it can be within an hour or two. While not always to-the-second “instant”, it’s still very quick. Fees on Yellow Card are usually built into the exchange rate spread.

- Busha, Bundle, Breet, etc.: These are Nigerian crypto-fintech apps that have streamlined the cash-out process. For instance, Breet markets itself as an OTC instant crypto converter – you send crypto to the Breet app and withdraw Naira without needing to find buyers. Busha and Bundle (by Binance) also allow selling USDT to NGN with bank withdrawal. Always check the withdrawal processing times; some promise under 5 minutes, others may take a couple of hours depending on banking networks.

Pros: Very easy for beginners, minimal steps, built-in compliance (you know the company is handling the trade). Good for medium to large cashouts where trust is important.

Cons: Slightly lower rates than the absolute best P2P price, due to fees. Requires KYC verification (which can be a pro for safety, but an extra step nonetheless).

Read More: Buy MTN Data With USDT Instantly (2026)

2. Peer-to-Peer (P2P) Exchanges

P2P marketplaces let you sell USDT directly to other individuals for Naira. The most famous example is Bybit P2P, but there are others like KuCoin P2P, Bitget and local groups.

How it works on Bybit P2P: You list an offer (or pick an existing buyer’s offer) for a certain amount of USDT at a certain rate. The platform escrows your USDT. The buyer sends Naira to your bank account via bank transfer. Once you confirm receipt, you release the USDT from escrow to the buyer. This can be very fast – often completed in 15-40 minutes if the buyer is prompt and using instant bank transfers. The advantage is you often get a high exchange rate. For example, if the mid-market rate is ₦1450/$, P2P buyers might be willing to pay ₦1480 or ₦1485 per USDT, especially for smaller amounts, since demand for USDT is high.

Pros: Best exchange rates because of competitive market bidding. Zero platform fees (Bybit doesn’t charge P2P fees), so you get the full agreed amount. You can choose from many buyers and pick one with good ratings, high completion, and who uses your preferred bank for potentially faster transfer.

Cons: You must be vigilant to avoid scammers. Always confirm money is in your bank (preferably available balance, not just SMS notification) before releasing crypto. There’s a known scam where bad actors send money and then withdraw it (via false claims) – so ensure the payment is fully cleared. Use the P2P platform’s chat and follow guidelines. Another con is if you’re selling a very large amount, it may be hard to find one buyer instantly; you might have to split into chunks. Also, P2P relies on bank transfer infrastructure – rarely, a transfer might be delayed by bank issues, which slows the trade. Overall, P2P is fairly safe on big platforms with escrow, but it requires attentiveness and a bit of experience.

3. Crypto Exchanges (Trading to NGN on Exchanges)

A more traditional route: use a cryptocurrency exchange that supports NGN. A few Nigerian exchanges (like Quidax, Luno, or Remitano) and some international ones allow trading USDT/NGN pair. Essentially, you’d deposit USDT to the exchange, sell it on their order book for NGN, then withdraw NGN to your bank.

In 2026, with the CBN’s friendlier stance, some exchanges have re-enabled Naira deposits/withdrawals directly. For example, Luno Nigeria had turned off NGN for a while but might reinstate it with new regulations. Quidax, being Nigeria-based, often had withdrawal options. If using this method, once you place a sell order, it’s instantly matched (if you use market price) and you have NGN balance on the exchange. With a linked bank account, you withdraw to bank. Withdrawals might take anywhere from instant (if the exchange has a payment processor or same-bank accounts) to a few hours, usually within the day.

Pros: Good for those who are already comfortable with exchanges. You often get a decent rate, similar to P2P market rate. It’s a structured environment; you don’t directly deal with buyers.

Cons: Exchange withdrawal fees might apply, and the speed depends on banking channels. If there are any outages or liquidity issues on NGN markets, it could delay. Also, not many global exchanges offer NGN trading due to past regulatory issues – so your choices might be limited. It’s a bit less “instant” compared to a direct off-ramp app or a quick P2P trade.

4. OTC Brokers / Informal Trades

Before the advent of robust apps, many Nigerians used to convert USDT to naira via OTC (over-the-counter) brokers – essentially, a trusted individual or shop that would buy your USDT and hand you cash or bank transfer. This still exists (in markets like Lagos’ computer village, etc.), but it’s risky and usually not as instantaneous unless you personally know the broker. Rates can also vary. With so many secure digital options now, OTC in person is less popular. We mention it for completeness: if you have a reliable connection, it’s an option (you meet, they scan your wallet QR, you transfer USDT, they give you cash on the spot). For most, though, using a platform with escrow or automation is safer and easier.

Step-by-Step Guide: Convert USDT to Naira via Ravasend

Let’s detail the process using the Ravasend app as an example of an instant off-ramp:

- Set Up the App: Download the Ravasend app and create an account (if you haven’t already). Complete KYC verification – typically a one-time submission of your ID and possibly a selfie. This ensures you have higher limits and a secure account. Ravasend values compliance and user security, working only with licensed partners.

- Deposit USDT: In the app, navigate to the wallet section and select USDT. You’ll be given a deposit address (make sure to choose the preferred network, e.g. Tron TRC-20). Send your USDT to this address. Within a few minutes of blockchain confirmation, your USDT balance will show up in the app. Note: If you already have USDT on another wallet app that Ravasend supports via wallet connect or similar, that could be used too – but depositing in-app is straightforward.

- Initiate Conversion: Find the Convert option (in Ravasend’s interface) to convert USDT to naira. Enter the amount of USDT you want to convert. The app will show a preview of the transaction – for example, “50 USDT → ₦39,200” (using an illustrative rate). It will also display the fee clearly, e.g. “1% fee included”.

- Provide Payout Details: Enter the Nigerian bank account where you want the Naira to be sent. You’ll typically select your bank from a dropdown and input your account number. The name on the bank account should match your verified name on the app (for compliance). Ravasend allows withdrawals to all major Nigerian banks. If the app supports it, you might also have options like cash pickup or mobile money, but bank transfer is most common.

- Confirm and Receive: Review the details and confirm the conversion. The USDT will be deducted from your balance. Now you just wait a short moment. Behind the scenes, Ravasend’s system is matching your trade to liquidity providers or using their reserves to instantly pay out. In a successful scenario, you’ll get a notification: “₦39,200 has been deposited to your account ending 1234.” Check your bank – the money should be there, available for use. Most transactions are completed within minutes (often under 5 minutes during business hours). If there’s any delay, Ravasend retries or refunds the crypto, but such cases are rare.

That’s it – you’ve converted USDT to Naira instantly! No need to chat with buyers, no uncertainty.

The process on other apps is analogous: deposit → sell/convert → enter bank → confirm → receive. Some apps like Yellow Card or Busha may require an extra step to explicitly withdraw after selling, whereas Ravasend combines the sell+withdraw into one action.

Safety and Best Practices

While converting USDT to NGN is easier than ever, you should still follow best practices to ensure a smooth and secure experience:

- Use Reputable Platforms: Stick to known exchanges and apps with a track record. If a new service claims super-high rates or zero fees, vet it carefully – search for reviews or check that they are regulated. The platforms we discussed (Ravasend, Binance, Yellow Card, etc.) are well-established.

- Beware of Scams: If you’re using P2P, only communicate within the platform. Never release your USDT until you have confirmed the payment. Scammers might try to trick you with fake alerts or ask you to release crypto prematurely – don’t fall for it. Additionally, be cautious of phishing sites; ensure you’re using the official app or website of the service (bookmark it or use direct links).

- Check Rates but Don’t Be Greedy: It’s good to compare who offers the best NGN rate for your USDT. P2P often wins here. However, an offer that is way above market (too good to be true) could be a red flag. It might be a scammer attempting something fishy. It’s better to execute multiple small trades with highly rated buyers than one huge trade with an unknown new buyer offering a sky-high rate.

- Know the Fees: Each method has its cost structure. P2P might have bank transfer fees (some banks charge ₦20-₦50 for incoming transfers beyond a certain count). Off-ramp apps have a percentage fee. Some exchanges have withdrawal fees (e.g. ₦300 flat). Be aware so you’re not surprised. If you’re cashing out a large amount, those fees are minor; if small, consider them in your decision.

- Keep Records: Save receipts or screenshots of transactions until everything is finalized. If you do a P2P trade, document the chat and payment proof. If using an app, you typically have an e-receipt or email. In case of any dispute or error, these records help support resolve things quickly.

- Tax Implications: As crypto becomes regulated, be mindful of any tax laws. Currently, Nigeria is still fleshing out how to tax crypto transactions, but profits from trading might eventually be reportable. When converting large sums to NGN and depositing in your bank, ensure you can explain the source (especially if you’re a frequent trader or doing business volume). Using KYC-ed platforms actually helps, as they keep an audit trail. It’s always better to be transparent and comply with any future guidelines.

FAQs

Q: How fast is “instant”? Will I really get Naira in minutes?

A: With the top services, yes – you often receive Naira in under 1 minutes. For example, Ravasend typically completes withdrawals in a few seconds during banking hours. P2P trades on Bybit can be done in 15-30 minutes if you pick an active buyer. Keep in mind that times can vary: if you initiate at 3 AM, a bank transfer might wait until the next morning. But during normal hours, these platforms are designed for speed. Always factor in a little buffer (network congestions or bank network delays can rarely happen), but it’s a far cry from the old days of waiting 24+ hours. “Instant” essentially means as fast as technology and banking networks allow – usually nearly immediately or just a few minutes.

Q: What’s the best way to get the highest conversion rate?

A: Peer-to-peer exchanges generally offer the best rates because you’re dealing directly with buyers in an open market. If the market rate is ₦800/$, you might find buyers on P2P offering ₦805 or ₦810, especially for smaller lots, as they compete. However, the difference might not be huge compared to a good off-ramp app. If a platform like Ravasend or Yellow Card offers ₦790-$795 net after fees, that convenience might be worth the few naira difference. For large volumes, even a small rate difference adds up, so some people split their conversion: e.g. do some via P2P to maximize rate, some via instant app for guaranteed quick liquidity. In summary, check P2P rates, check one or two app rates – if an app’s rate is within a percent or two of P2P, it’s already quite good.

Q: Is KYC required to cash out USDT to my bank?

A: In most cases, yes. Licensed platforms will require at least a one-time KYC (Know Your Customer verification) because they are essentially facilitating a currency exchange. This usually means providing a government ID and possibly a selfie or proof of address. P2P on Binance or others will require you to verify identity as well (plus it’s safer, as verified traders are more trustworthy). While it might be possible to find informal cash buyers without KYC, it’s not recommended for safety and legal reasons. Embracing KYC on legitimate services is part of the crypto maturing process in Nigeria – and given the new regulations, it’s expected. The upside is you get more protection and higher limits by doing so.

Q: Are there limits on how much I can convert at once or per day?

A: Platforms impose limits based on your verification level and sometimes regulatory requirements. For instance, Centry might have tiers – unverified accounts can convert only a small amount, fully verified accounts can do much more (hundreds of thousands or millions of naira) per day. Bybit P2P technically has no fixed limit, but each buyer will have their own max offer size; you might do multiple trades if you’re cashing out a large sum (e.g. ₦5 million) to stay under any single buyer’s limit. Nigerian banks may also have limits on how much can be received in one go or per day, especially into certain account types. Generally, if you plan to convert very large amounts (like over ₦10 million), it’s wise to break it into smaller batches and possibly spread across days or banks to avoid triggering any bank compliance red flags. But for typical everyday use (₦50k, ₦200k, ₦1m), the available services can handle it in stride

Q: What about taxes or bank questions when large funds hit my account?

A: As of this year, Nigeria doesn’t have a specific crypto tax, but general tax laws on income may apply. If your USDT represents income (say from work or trading profits), officially you should be mindful of declaring it. Practically, many Nigerians treat crypto like an informal sector – but this could change with regulations. If a very large amount suddenly flows into your account, your bank might ask for the source of funds as part of anti-money laundering checks. It’s good to keep records (trade logs, etc.) to show it came from crypto trading or sales. Because crypto is now recognized, explaining “I sold cryptocurrency I owned” is increasingly accepted, but be prepared to show documentation if needed. For most small conversions, this is not an issue. It becomes more relevant for business-level transactions. When in doubt, consult a tax professional. On the flip side, one benefit of using regulated off-ramps is they can provide account statements or histories which help in explaining your source of funds if ever queried

Conclusion

Converting USDT to Naira in Nigeria is easier and faster than ever this year. With a robust crypto ecosystem and improving regulations, you have multiple solid options to go from digital dollars to spendable Naira in a flash. Whether you choose an instant off-ramp app like Ravasend for its simplicity and high rate, a P2P marketplace for top rates, or a combination of methods, you can access your money when you need it.

No more worrying about “How do I get this crypto into my bank?”. By following this guide, you can confidently convert USDT to NGN to pay bills, withdraw cash, or invest locally. Always prioritize safety: stick to reputable platforms, follow best practices, and keep records. The convenience of crypto off-ramps is a game-changer for financial freedom – Nigeria’s high stablecoin adoption is proof of that trend.

Finally, if you’re looking for a recommendation: give Ravasend a try for your USDT to naira cash-out. Its blend of speed, security, and decent rates strikes a great balance for most users. The ability to go from having USDT in your wallet to naira in your bank in one app, within minutes, is incredibly empowering. Download the Ravasend app today and experience the ease of instant crypto-to-fiat conversion. Your money, your way – on your schedule.